To own a home is said to be the American dream. And for many, this is true. A dream of fixed monthly payments over 30-years vs. an unknown amount of rent increases, landlord dealings, and potential moves. You acknowledge the short-comings of home-ownership: maintenance issues, property taxes, home insurance, etc. However, these items offset the uncertainties that come with renting AND you get to build equity in the process. Many believe that equity is as good as easy money that they can one day tap into.

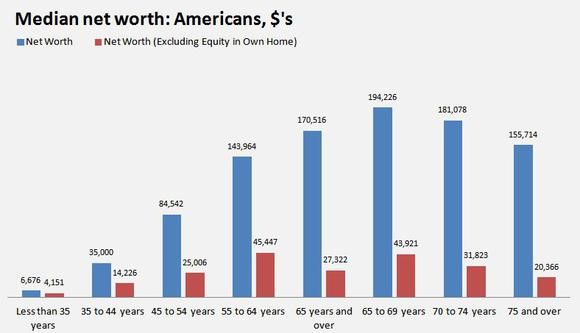

The chart below as provided by fool.com, highlights this fact that a significant chunk of America’s Net Worth is tied to their homes.

The scary part is this money is tied up and is not available to spend.

The problem is the 30-year mortgage. Our inability to stay in one place for any length of time doesn’t help the situation either. Generally speaking, home ownership is only beneficial financially to the owner, if one stays at a location for a significant length of time (at least greater than 7 years). Transaction costs are enormous and equity is generally built in the back of the mortgage given the amortization schedule.

Other pitfalls of purchasing a home include the other players involved in the transaction. Who are your counterparts when purchasing a home? Real estate agents (profiting off the more expensive and larger home you buy) and bankers / finance agents, who yet again profit with a more expensive and larger home. While their interests are supposed to align with you, they don’t. They make more money by getting you into the largest home and financing the largest amount you can afford. The 30-year mortgage is the conduit to get you into that home. That leads us into the first issue.

Key Issue 1: a 30-year mortgage helps you purchase more home than you could possibly need.

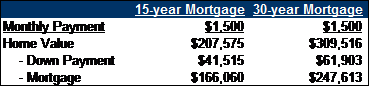

Your income dictates the amount of money a bank is willing to lend to you. Several factors go into this calculation, but generally speaking a lender is willing to offer around 30% of your income towards a mortgage. We’ll use $1,500 a month as a proxy ($60K annual household income equivalent) and this will include P&I (principal and interest on the mortgage) as well as Property Taxes and Property Insurance.

For simplicity: property taxes, property insurance, and interest rate were held constant. In reality, each of these variables would be less expensive for the 15-year mortgage scenario and would save an even greater amount than what is presented below. The larger home would also cost an additional amount of maintenance (generally estimated at 1% of a home value annually), utilities, etc.

In summary, both scenarios require a payment of $1,500 a month, but the 30-year mortgage gives you the “opportunity” to purchase a home that will set you back an additional $100,000.

If you can’t afford to purchase the home you want with a 15-year mortgage, you should wait to buy.

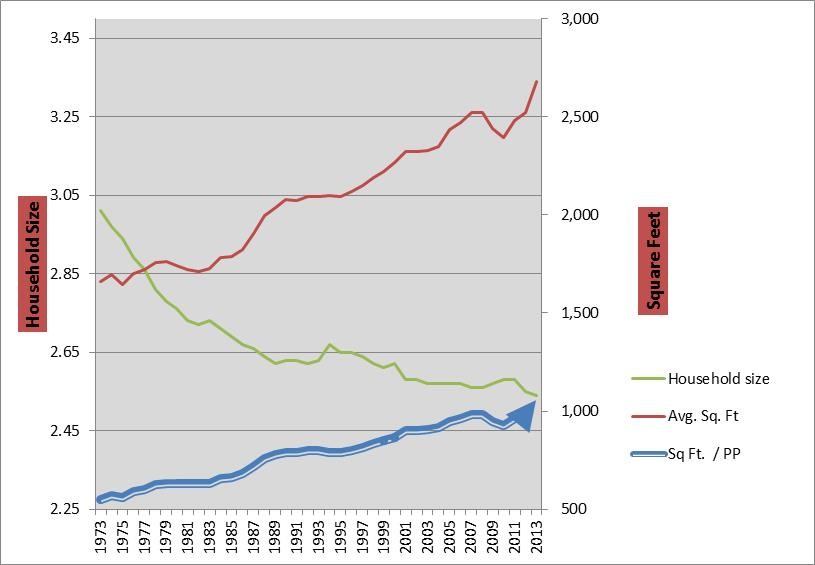

This would mean that a significant amount of people who think they are ready to purchase a home, would have to continue renting. Or, perhaps rethink the size of the house and associated cost to bring down the cost to an affordable 15-year option. The supersize me lifestyle has certainly affected what we perceive we need in a home. From 1973 to 2013, there was a 91% increase in square foot per person. In 2013, this resulted in over 1,000 square feet per person. The following graph shows that while the average household size (number of occupants) decreases, the average size of a residence (sq. ft.) continues to shoot upwards.

You’ll need to ignore your real estate agent telling you what amazing house you can afford and instead focus on the core fundamentals of what you need in a property and what you can afford on a 15-year basis.

Key Issue 2: You pay significantly more in interest expense during the 30-year term.

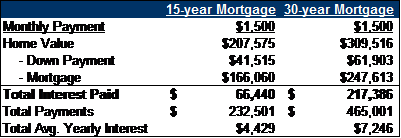

You pay a proportionally larger amount of interest expense using a 30-year mortgage. Let’s continue the example from above and show how much money you’ll save by purchasing the home you can afford with the 15-year mortgage.

You pay more than three times the interest in the 30-year mortgage scenario.

On the 30-year mortgage, you pay $217K in interest expense, or nearly 50% of your payments. This is $7.2K of interest expense per year on average, a majority of which is paid during the first half of the mortgage. You pay more per month in interest than in principal until you reach month 186 (more than 15 years into the mortgage).

On the 15-year mortgage, you pay $66K in interest (less than 30% of your payments are for interest). This is $4.4K of interest expense per year on average. You only pay more in interest than in principal for the first 6 months of this 15-year mortgage as compared to 186 months on the 30-year.

This is a difference of $151K, money that could be invested and working for you, instead of going down the drain in interest expense.

Key Issue 3: the lack of equity built during the early stages of a 30-year mortgage is restrictive.

This is also one of the key rationales for renting vs. owning. We don’t know what life is going to throw our way. Job opportunities, or even job loss, marriage/divorce, aging parents to care for, etc. While renting provides the most adaptability and flexibility to change, the 15-year mortgage provides a similar advantage vs. the 30-year mortgage.

Let’s say for whatever reason, you need to move after four-years of purchasing a home.

- With the 15-year mortgage, you will have paid principal of roughly 20% of your mortgage. Combine that with your 20% standard down payment, even with no growth in your home value, you will have material equity in your home available to you.

- With the 30-year mortgage, you will have paid principal of roughly 6.5% of your mortgage. This highlights the disadvantage of the 30-year mortgage. This means you only have about 1/3rd of the equity as compared to the 15-year mortgage. Side note: if you can’t afford a 20% down payment, you are not ready for home ownership. There are too many “hidden” (intentionally ignored) costs that come with home ownership. If you can’t save appropriately for a down payment, are you going to save properly to fix the A/C, roof, water heater, etc. that will certainly happen at an “inopportune time”.

Key Issue 4: you are tying up key capital that you could put to work for you.

Your personal residence is NOT an investment. Home values have generally kept up with inflation over the long run. Add in maintenance upkeep, taxes, insurance, etc. and your home certainly is not a long-term wealth generating investment. However, the stock market is. The stock market is also extremely easy and inexpensive to diversify unlike your personal residence which is completely location specific with no diversification. It also doesn’t have huge fees and expenses that are associated with home expenses.

The 15-year mortgage scenario from above included a lower down payment of $20.4K (difference between the 15-year and 30-year down payments). Invest that in the stock market for 15 years at a 7% average CAGR (compound annual growth rate), you will have $56.3K at the end of the 15-years.

Oh, also at the end of those 15-years, you will be MORTGAGE FREE. You won’t have an additional 15-years of mortgage payments where you will just start to materially pay down the mortgage balance!

Do yourself a favor, purchase a home you can actually afford and that means a 15-year mortgage at the maximum.